In the world of business and taxation, a GST invoice is a fundamental document. It serves as proof of supply of goods or services and is critical for both sellers and buyers to claim input tax credit. This blog post will guide you through the essentials of GST invoices, including the required GST invoice format, key elements, and best practices for creating and managing these invoices effectively.

What is a GST Invoice?

A GST invoice is a document that lists the details of a supply of goods or services, issued by the supplier to the recipient. It is a legal document under the Goods and Services Tax (GST) law in India and must be issued by every registered dealer. The invoice ensures transparency, compliance, and helps in the accurate calculation of taxes.

Importance of GST Invoice

- Legal Compliance: Issuing a GST invoice is mandatory under the GST law for every taxable supply of goods or services.

- Input Tax Credit: The recipient can claim the input tax credit based on the GST invoice issued by the supplier.

- Record Keeping: GST invoices are essential for maintaining accurate records and preparing financial statements.

- Proof of Supply: The GST invoice serves as evidence of the supply of goods or services, which is essential for resolving disputes and audits.

Mandatory Components of a GST Invoice

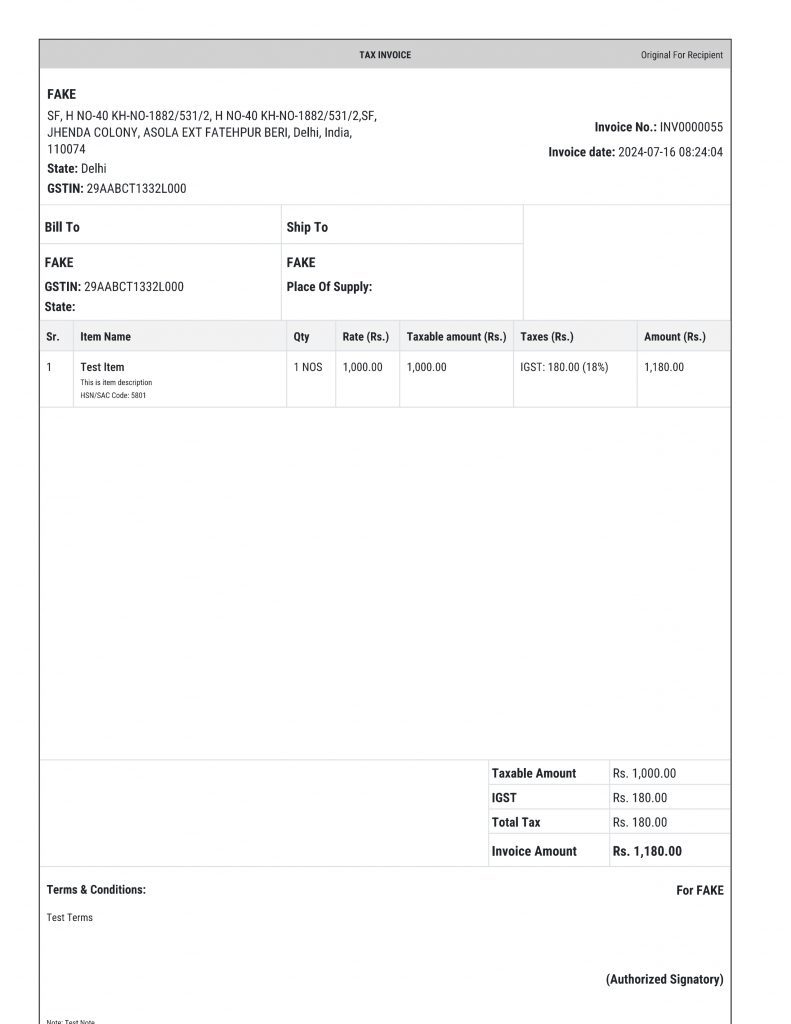

According to the GST law, a GST invoice must contain the following components:

- Invoice Number and Date: A unique serial number and the date of issue.

- Supplier’s Details: Name, address, and GSTIN (Goods and Services Tax Identification Number) of the supplier.

- Recipient’s Details: Name, address, and GSTIN (if registered) of the recipient.

- Description of Goods or Services: A detailed description of the goods or services supplied.

- HSN/SAC Code: Harmonized System of Nomenclature (HSN) code for goods or Service Accounting Code (SAC) for services.

- Quantity and Unit: The quantity of goods and the unit of measurement.

- Total Value: The total value of the goods or services supplied.

- Taxable Value: The value on which GST is to be applied.

- GST Rates: Applicable GST rates (CGST, SGST, IGST, UTGST) and the amount of tax charged.

- Total Amount: The total amount payable including GST.

- Place of Supply: The place of supply in case of inter-state transactions.

- Signature: The signature or digital signature of the supplier or an authorized representative.

GST Invoice Format

A GST invoice format is standardized to ensure consistency and compliance. Here’s a sample format of a GST invoice

Types of GST Invoices

There are different types of GST invoices based on the nature of the transaction:

- Tax Invoice: Issued for the supply of taxable goods or services.

- Bill of Supply: Issued for the supply of exempted goods or services or by a composition dealer.

- Debit Note: Issued when there is an increase in the value of the invoice.

- Credit Note: Issued when there is a decrease in the value of the invoice.

Conclusion

A GST invoice is a critical document in the GST regime, ensuring compliance and facilitating the claiming of input tax credits. By following the standard GST invoice format and including all mandatory components, businesses can maintain accurate records and stay compliant with the law. AccoXpert’s accounting solutions can further streamline the process, making it easier to generate and manage GST invoices efficiently.

By understanding and adhering to the requirements for a GST invoice, businesses can ensure smooth operations and avoid any legal or financial complications.

Stay compliant and streamline your invoicing process with AccoXpert!